The Economics of Birth to Five

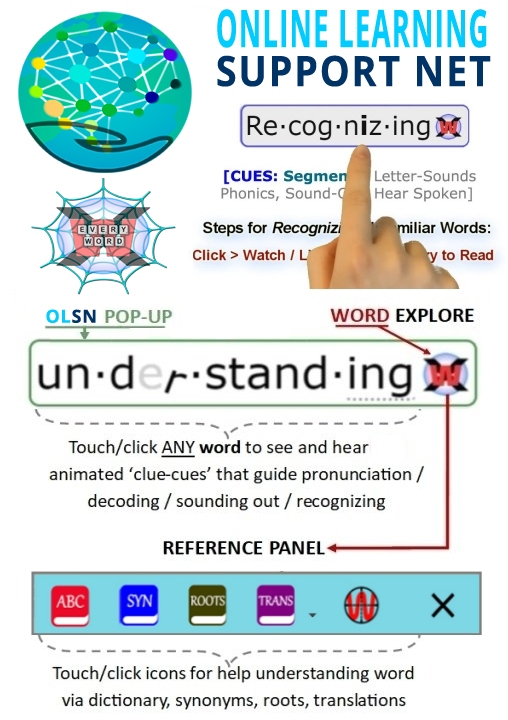

Note: Remember to click on any word on this page to experience the next evolutionary step in technology supported reading.

Development of Economic Argument for Investing in Birth to Five

… If done right, high-quality, parent involvement, working with kids birth to five, you can make an extraordinary difference down the road.

There are some excellent longitudinal studies, as well as more current studies, that strongly suggest there’s a very high public return – public, not just private, but public return, if you invest in birth to five and do it right.

What I mean by ‘do it right’ is that it needs to be high quality. It needs to be master level teachers and it includes home visits and working with the parent(s). If done right, especially for at-risk children, these studies show dramatic differences; where the kids who receive these kind of early education programs compared to a randomized control group that didn’t. So, the methodology is about as good as you can get that shows that these kids are much more likely to be literate by the third grade on. More current studies that aren’t the longitudinal ones, (and these longitudinal ones follow these kids for thirty, forty years), confirm that within three or four years you can see dramatic improvement in at-risk children’s success in third grade.

Arthur Rolnick, Senior Vice President & Director, Federal Reserve Bank of Minneapolis; Author: “The Economics of Early Childhood Development.” Source: COTC Interview http://www.childrenofthecode.org/interviews/rolnick.htm

Return on Investment - Investing in Birth to Five

There were benefit/cost ratios in these studies of anywhere from eight to one to seventeen to one. We actually went and calculated a rate of return, which nobody had quite done before, that if invested and invested well, what’s the return to the public? What’s the overall return? We found that annual rate of return from this one study, (there’s four studies all pointing in the same direction) of sixteen percent inflation adjusted. Twelve percent of that was a public return because the student is less likely to need special education, he’s less likely to be retained in the first grade, is more likely to get a job, stay off of welfare, pay taxes, and the crime rate goes down significantly.

So, we said, “Look, hands down, this beats conventional economic development, which we argued was a zero public return. And it stacks up pretty well to any private return. We argued this was a pretty safe investment because we know how to do this, and if focused and done right we were very sure we could get these kinds of results. So, relative to private returns and relative to virtually any sort of public investment you can make today, this would have to be high on your list.” Typically, it’s either low on the list or it doesn’t even appear as public investment.

Your original question was how did I get involved. It is kind of through the back door, looking at economic development and realizing most of the economic development that we’re funding in this country is counter productive. There is an area in which we’re way under-funding and it’s birth to five. It should be viewed not just as education, but as economic development.

Arthur Rolnick, Senior Vice President & Director, Federal Reserve Bank of Minneapolis; Author: “The Economics of Early Childhood Development.” Source: COTC Interview http://www.childrenofthecode.org/interviews/rolnick.htm

Parental Involvement is Key

…One type of resistance comes from the far right. They’re worried that we’re going to take children away from their families. I point out that the research strongly, strongly suggests that parent involvement is a key factor in getting the kind of return we’re talking about. We’re not talking about taking the children in these low-income families out of the family, just the opposite. We’re talking about working with the family, because the studies show you’ve got to get the parent engaged.

Essentially, you’re educating the parent on parenting and it’s a critical component. The programs that we are advocating suggest to get the high return includes a mentor with the parent at a very early age. The brain development people will tell you in the most stressful environments, most at-risk children, you have to get them by three. You can’t wait until four or five, even, that can be too late. So, we’re talking about mentors in families from birth on.

So, when we talk about high quality programs, we mean parent involvement, we mean home visits, we mean educating the parents as well as the child. That seems to dissipate that problem.

Those kinds of programs, they may look expensive. Relatively speaking, they’re not, because the return is so high.

Arthur Rolnick, Senior Vice President & Director, Federal Reserve Bank of Minneapolis; Author: “The Economics of Early Childhood Development.” Source: COTC Interview http://www.childrenofthecode.org/interviews/rolnick.htm

Universal Pre-K

A universal four year-old early education is a good first step. I’m not sure it’s the best first step, though. The programs that we argue for are focused on at-risk families, birth to five, with a mentor going to the house. We actually talk about scholarships for these families. The scholarships are tuition-plus. So, the plus is the mentor, tuition is when the child turns three and four, then they get to send their child to a high-quality early education program.

It’s a program that covers birth to five. If you just go at four year olds, and if you do it universal, you end up subsidizing a lot of families that don’t need it, as we talked about earlier. It’s not focused on the real needs because it’s starting too late in many cases. So, I think universal four year old is a good step, but I think where the highest return is, and where the most need is, is birth to five in the at-risk families.]

Arthur Rolnick, Senior Vice President & Director, Federal Reserve Bank of Minneapolis; Author: “The Economics of Early Childhood Development.” Source: COTC Interview http://www.childrenofthecode.org/interviews/rolnick.htm

Financial Fulcrum Efficiency of Birth to Five Investments

We should be putting much more at the foundation, in the birth to five. Percentage-wise, it’s minuscule compared to the resources that we put into kindergarten through twelve. Again, I think it’s a rethinking of the importance of birth to five. I think most of us don’t understand how critical those learning years are, how critical those years are to the architecture of the brain, how critical those years are for success in the future.

Arthur Rolnick, Senior Vice President & Director, Federal Reserve Bank of Minneapolis; Author: “The Economics of Early Childhood Development.” Source: COTC Interview http://www.childrenofthecode.org/interviews/rolnick.htm

Supporting Families with Tools

There is an attitude out there that this is the job of the parents – birth to five is not public education. I think that’s something we have to grapple with and explain to people, yes, it is the job of the parents. The tools that we’re talking about are tools we’re offering. We’re offering opportunities for these parents, the at-risk parents, so their kids have the same opportunities as the rest of the kids.

Arthur Rolnick, Senior Vice President & Director, Federal Reserve Bank of Minneapolis; Author: “The Economics of Early Childhood Development.” Source: COTC Interview http://www.childrenofthecode.org/interviews/rolnick.htm

Conventional Economic Development is Counter Productive

In Minnesota here, we’re talking about two new stadiums, one for the Twins and one of the Vikings. The cost is 1.5 billion. One and a half billion will give me a big enough endowment so that I can insure that every at-risk child in Minnesota will have a high-quality early education program. Two stadiums versus high-quality early education: I don’t think there’s a real choice here.

Arthur Rolnick, Senior Vice President & Director, Federal Reserve Bank of Minneapolis; Author: “The Economics of Early Childhood Development.” Source: COTC Interview http://www.childrenofthecode.org/interviews/rolnick.htm